HOCHIMINH CITY, Vietnam, Dec. 09, 2024 (GLOBE NEWSWIRE) -- Cake Digital Bank, Vietnam's pioneering digital bank, announced it has achieved a remarkable milestone, becoming the first digital-only bank in Vietnam to attain profitability merely 3.5 years after its inception. This underscores Cake's profound impact on Vietnam's financial sector as it redefines banking for tech-savvy, young, and underserved consumers.

Cake Digital Bank's significant growth trajectory has been a key driver of its success

Launched in 2021, Cake has demonstrated efficiency and scalability, achieving breakeven in June 2024, a critical milestone for digital financial institutions. By Q4 of 2024, Cake announced profitability, distinguishing itself as the first digital-only bank in Vietnam to achieve such a distinction.

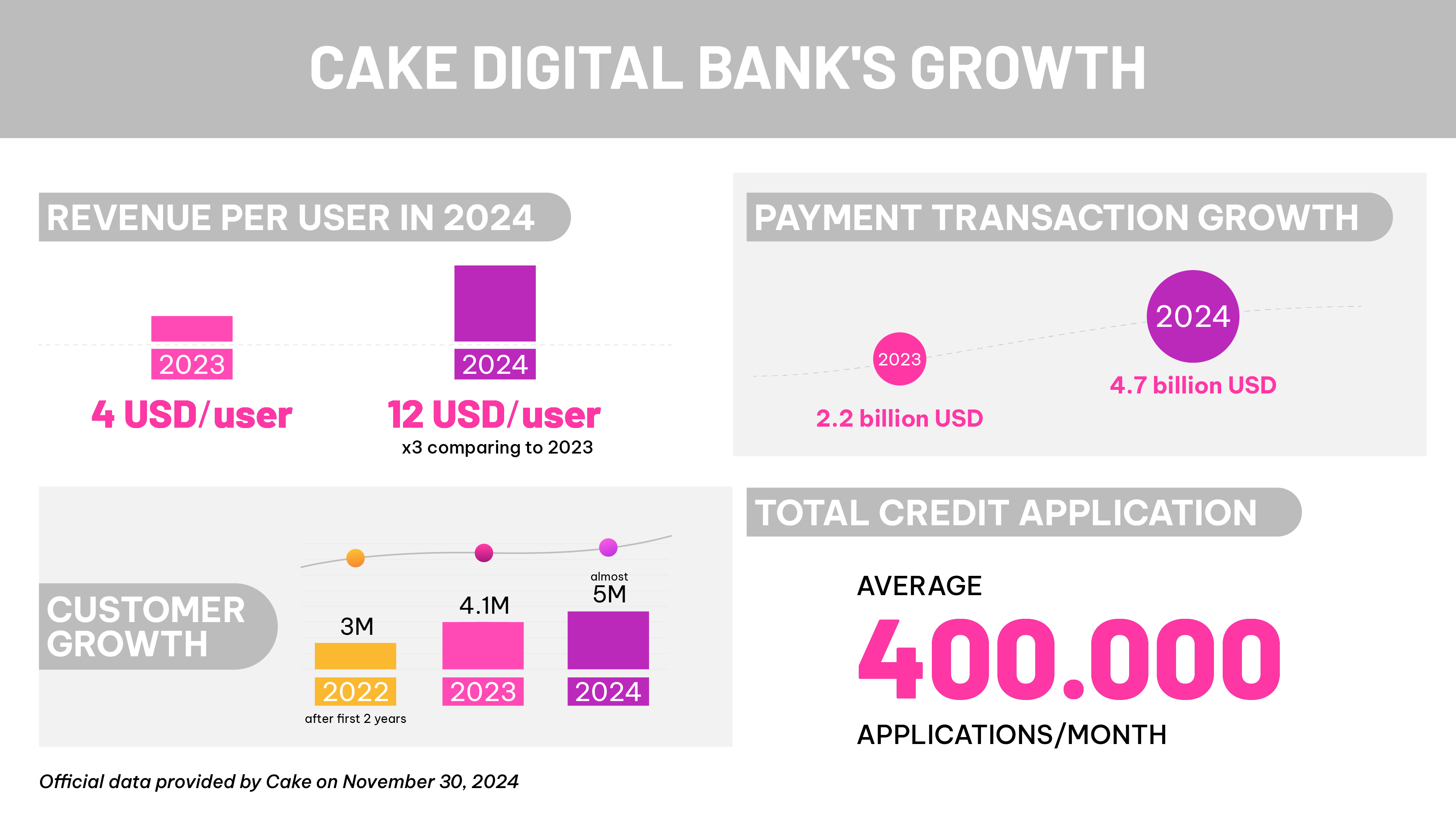

This remarkable success is fueled by outstanding business performance. The revenue per user reached US$12 in 2024, a substantial threefold increase from the US$4 per user recorded in 2023. The client base expanded from 3 million in the first 2 years to 4.1 million by the end of 2023 and reached nearly 5 million in 2024.

Additionally, Cake's robust pipeline of credit operations is evident, with an average of 400,000 credit applications processed monthly—an impressive number for a digital-only bank in Vietnam.

In alignment with its strategic roadmap, Cake aims to position itself within the top 5% of the world's most profitable digital banks, emphasizing its commitment to sustainable growth within the competitive fintech landscape.

Cake’s CEO Nguyen Huu Quang stated: “Cake Digital Bank's significant profitability milestone reflects our unwavering commitment to innovation, customer-centric services, and sustainable growth. Our team's dedication and customers' trust have been pivotal in reaching this landmark. As we look ahead, we remain steadfast in advancing financial inclusion and delivering exceptional digital banking experiences for all.”

Effectively address market demands and enhance AI application

Cake has achieved a remarkable profitability milestone primarily by meeting the diverse banking needs of its target demographic, particularly the tech-savvy Gen Z and young Millennials.

By 2024, about 77% of Vietnamese adults have bank accounts, reports The State Bank of Vietnam. The banking sector, once dominated by traditional banks, is now seeing new entrants targeting young and underserved customers.

As Vietnam’s pioneering digital-only bank, Cake is well-designed to provide an accessible and straightforward banking experience for everyone and encourage financial inclusion. The digital bank offers a comprehensive range of financial products tailored to all banking needs. Emphasizing convenience, their "Easy as Cake" slogan is reflected in processes like quick account setup, instant money transfers, etc, ensuring that banking is both effortless and instantaneous.

Moreover, with a strong network of partners across diverse industries such as ride-hailing, telecommunications, entertainment, etc, Cake can be a one-stop shop for every financial need.

As a result, Cake’s payment transaction growth reached US$4.7 billion in 2024, doubling the US$2.2 billion recorded in 2023. The bank boasts an impressive customer retention rate of 80% based on transaction frequency and 95% based on financial engagement. This indicates strong customer satisfaction, contributing to Cake's sustainable profitability.

Leveraging cutting-edge technology, Cake creates perfect financial experiences with AI-driven solutions. Through sophisticated analysis of consumer needs, Cake delivers an array of personalized offerings for diverse customer demographics. This strategic AI integration extends beyond products into Cake's business activities, reducing operational expenses and improving profit margins while enhancing the user experience.

Cake's innovative use of AI has earned industry accolades, such as the “Technology Bank of the Year” and the “Best AI Technology Implementation”. These awards highlight Cake's leadership in AI-driven banking.

https://www.globenewswire.com/NewsRoom/AttachmentNg/9fef0d12-3125-4451-9f09-267f09f4db29

Media contact: theresa.tran@cake.vn

source: Cake Digital Bank

【香港好去處】2025去邊最好玩?etnet為你提供全港最齊盛事活動,所有資訊盡在掌握!► 即睇