SYDNEY, Australia, May 27, 2024 (GLOBE NEWSWIRE) -- Polymetals Resources Ltd (ASX: POL) (Polymetals or the Company) is pleased to announce that it has formed a non-exclusive strategic alliance with Metals Acquisition Limited (ASX: MAC) to advance synergies aiming to extract greater value from both the Endeavor and CSA Copper Mines, both located in the Cobar Basin, NSW Australia.

HIGHLIGHTS

- MAC to invest up to $5.0 million @ $0.35/share in POL.

- POL and MAC to enter into an agreement to treat high-grade zinc ore at POL’s Endeavor Silver Zinc Mine.

- POL to provide MAC with excess water offtake to enhance CSA ore treatment capacity.

ALLIANCE OBJECTIVES

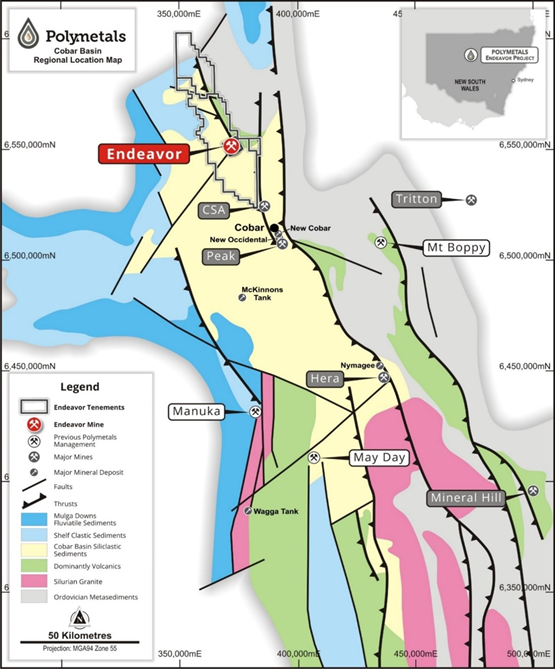

MAC owns and operates the high-grade CSA Copper Mine located 5 km to the north of Cobar NSW (Figure 1). Polymetals high-grade Endeavor Silver Zinc mine is located 30km to the north of CSA.

The alliance between MAC and POL will allow each company to exploit synergies between the neighbouring mines. The relationship aims to deliver enhanced operational and financial outcomes by increasing mine production at both projects.

Polymetals Executive Chairman Dave Sproule said:

“Polymetals has operated in the Cobar Basin for many years and is confident the alliance with MAC will generate significant benefit for all stakeholders. Both companies are managed by long term solution focussed operators which will unlock value from existing synergies and identify other opportunities as the relationship grows.

The Endeavor treatment plant has excess processing capacity which may be utilised by MAC should its current CSA zinc exploration prove positive. Polymetals has also been able to assist MAC with provision of a small portion of its water allocation (being excess to POL’s future needs) enabling the CSA mine to increase ore treatment rates into the future.

Polymetals looks forward to working with MAC and its CSA Mine operations team.

Bringing the Endeavor silver zinc mine back to production will be a great outcome for NSW and the Cobar community, creating over 200 direct jobs and injecting around $50m a year into the local community for at least another 10-years. The Endeavor mine life has potential to be increased with ongoing mine optimisation, exploration success and value adding treatment options.”

Figure 1 – Cobar Basin Mine Locations

Metals Acquisition Managing Director & CEO Mick McMullen said:

“We believe that this kind of transaction is an example of how cooperation in the Cobar Basin has the potential to extract the best value in the Basin…

By investing in POL we are creating a relationship to achieve better outcomes for both companies. We have known the POL management team for over 20 years. They bring a wealth of experience to the area and have the ability to operate mines very efficiently and we are very supportive of their efforts to reopen the Endeavor mine as well as exploring their immediate mine environment which like the CSA Copper Mine is very underexplored for all base metals including copper.”

METALS ACQUISITION - INVESTMENT TERMS

- Tranche 1 - MAC to invest an initial A$2.5 million at a price of A$0.35/share for an initial 4.31% interest in POL.

- the Company will issue 7,142,857 fully paid ordinary shares to MAC or its nominee. These placement shares being from the Company’s available Listing Rule 7.1 placement capacity.

- Tranche 2 - MAC to invest an additional A$2.5 million at a price of A$0.35/share, subject to satisfaction of certain conditions precedent including:

- POL and MAC entering into a tolling agreement to treat zinc ore delivered by MAC to POL (with a treatment charge of costs + 35%);

- POL securing sufficient funding to restart the Endeavor mine and processing plant;

- POL and MAC entering into a Water Offtake agreement whereby POL will allow MAC to draw up to 150ML of water annually from the Endeavor mine pipeline for a term of 4.5 years. MAC will have an option to extend beyond the initial 4.5 years on terms to be agreed in good faith between the parties, and;

- MAC securing any necessary third-party consents (including from its secured lenders and Glencore Plc) to undertake the transactions contemplated.

- MAC will have the right to appoint one director to the POL board once it holds 7% of the issued shares in POL.

NEXT STEPS

With the company now being able to defer the environmental bond replacement for up to two years1, taking full ownership of the Endeavor Silver Zinc mine operating assets, and formed its Strategic Alliance with MAC, the Company can progress to completing its Endeavor Mine optimisation and restart financing. Polymetals intend to commence planned Endeavor Mine refurbishment works early in H2 2024, with first concentrate output planned during H1 2025.

The Company will shortly provide details of its planned work programs.

This announcement was authorised for release by Polymetals Resources board.

For further information, please contact:

| Linden Sproule Corporate Development linden.sproule@polymetals.com |

ABOUT POLYMETALS

Polymetals Resources Ltd (ASX: POL) is an Australian mining and exploration company with a project portfolio with significant potential for the discovery and development of both precious and base metal resources. With our cornerstone asset the Endeavor Silver Zinc Lead Mine, one of the three large mines in Cobar NSW Australia, Polymetals is seeking to become a long term, consistent and profitable base and precious metal producer. Polymetals holds a strong exploration portfolio for organic growth, are development driven and continually measure strategic acquisition opportunities. For more information visit www.polymetals.com

FORWARD LOOKING STATEMENTS

Certain statements in this document are or maybe “forward-looking statements” and represent Polymetals’ intentions, projections, expectations or beliefs concerning among other things, future exploration activities. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks, uncertainties and other factors, many of which are beyond the control of Polymetals, and which may cause Polymetals’ actual performance in future periods to differ materially from any express or implied estimates or projections. Nothing in this document is a promise or representation as to the future. Statements or assumptions in this document as to future matters may prove to be incorrect and differences may be material. Polymetals does not make any representation or warranty as to the accuracy of such statements or assumptions.

1 Subject to shareholder approval at an upcoming general meeting. Refer ASX announcement “Endeavor Silver Zinc mine acquisition accelerated” dated 14 May 2024

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/16a0b6a2-705e-455e-8831-6c02bbf95df6

source: Polymetals

《說說心理話》 消費能獲取快樂?買不起,不如花光錢錢$$?「習得性無助」有何影響?一起看看正確理財觀念。► 即睇